An action plan to help navigate future MEES risks

The future risks associated with the Minimum Energy Efficiency Standards (MEES) has cropped up in our conversations with clients more than any other issue lately.

The reason, of course, is the government’s intention (confirmed in the Energy White Paper 2020) to increase the energy efficiency threshold a commercial building must meet before it can be let. This will be a ‘B’ EPC rating by 2030, less than 10 years away.

Given the current threshold is an ‘E’ rating, and only about 12% of all buildings achieve a ‘B’ rating at the moment, this is causing widespread anxiety.

But to add to the general confusion the government is also consulting on the introduction of operational energy ratings. These may or may not replace EPCs for buildings over 1000 sq m or a hybrid approach might be introduced allowing those assets which do not have a B rated EPC to continue to be let provided they adopt operational ratings as a route to compliance.

Securing a ‘B’ EPC rating, or a good operational energy rating, will in most cases require fundamental changes to building services such as heating, ventilation and air-conditioning. This is likely to lead to capital expenditure by landlords.

Real estate advisors Gerald Eve, in partnership with lawyers Irwin Mitchell and resero, have produced a guidance note on this very issue to try and provide some clarity. Download the full document here.

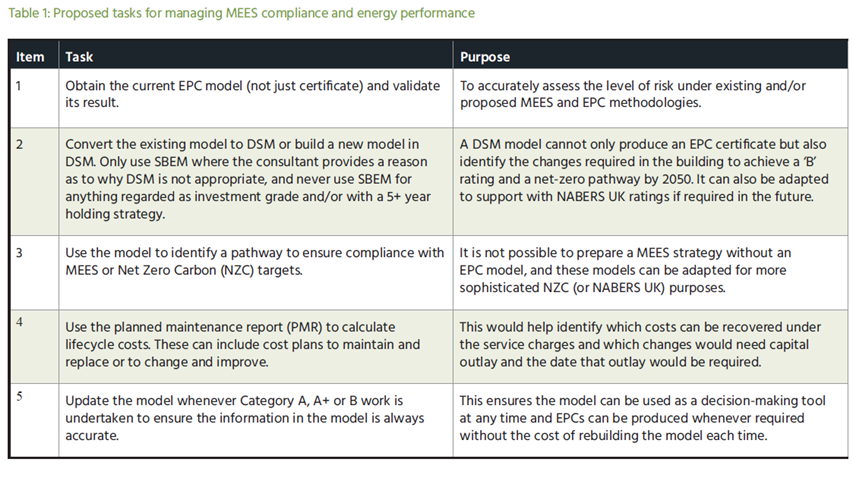

Resero contributed the following action plan for landlords to help navigate the current uncertainty.

Let me explain this approach in a little more detail. For most landlords the issue is how they determine the impact of the spend required on that asset’s value. To do so requires information in three key areas:

- What is the end goal for this asset – i.e. to be able to let the building in 2030, prevention of asset stranding or a net zero carbon pathway for 2050 for long term investment?

- What changes are realistic in this particular building having regard to its current engineering design and tenant use?

- How much of this spend can be reclaimed back through service charges? How much requires landlord investment, and when does the money need to be spent?

Building a dynamic simulation building model for each building

The first step is to have a dynamic simulation model (DSM), sometimes referred to as a digital twin, for each building.

Every EPC produced requires a building energy model to be built and there are two types of software used to generate these models – SBEM (simplified building energy model) and DSM (dynamic simulation model).

An SBEM model is built purely for the purposes of producing an EPC. A DSM is a model with far greater levels of detail and accuracy. Whilst it can generate an EPC it can also be used for a wide range of asset management purposes such as BREEAM calculations, climate change modelling and productivity metrics. It can also be adapted to undertake design work or run other simulations, such as the stress-testing of operational interventions. This would help secure improved future operational energy ratings such as NABERS UK.

DSM models are more expensive but offer flexibility and long-term asset management capability – key for navigating the current uncertain climate. It is not easy to convert an SBEM model to a DSM model, but it can be done by a skilled and suitably qualified modeller.

Determining which interventions are feasible

Sustainability consultants have a habit of estimating energy savings from blanket recommendations across building portfolios such as switching to LED lighting or installing PV (solar) panels on the roof.

But the engineering of each building is different and each change is likely to have a range of knock-on effects. For example, switching to LED lighting is always a good idea, but a knock-on-effect might be an increased thermal load (a requirement for additional heating). Therefore, any potential energy savings as a result of improved lighting needs to be considered alongside any potential increases to heating bills and even plant sizing. Smothering a roof in PV panels is of no use if engineers cannot physically get to the panels to clean or repair them and might even reduce future options to change HVAC systems.

By digitally simulating a range of interventions in consultation with contractors and engineers it is possible to understand the most cost-effective and realistic course of future action for each building.

The PMR and the ‘alternative PMR’

The real gap in the sector is linking strategies and proposed interventions with the planned maintenance costing processes for each building.

A Planned Maintenance Report (PMR) is a strategic asset management report. It provides the annual cost of repair and replacement of assets for the duration of the PMR term, which is usually for a 10-year period. Costs included in the PMR are typically recoverable through service charges meaning the emphasis is on repair or like-for-like replacement. A PMR does not therefore typically include the cost of changes that would improve the long-term sustainability and efficiency of a building as these are often not service charge recoverable.

Therefore, we have started producing what we call Alternative PMRs (APMR) alongside PMRs for some clients. This strategic document is aligned to the RICS New Rules of Measurement and includes the additional interventions and spend required to achieve a stated goal (either a target EPC rating or a net zero carbon pathway).

Impact on value calculation

The difference between the PMR and the APMR cost plan(s) is the potential impact on a property's value. This represents the additional sum of money that needs to be spent to realise a target.

We call this the ‘impact on value statement’ and it can be used to support an RICS qualified valuer with the valuation processes.

We also use a tool developed by the Carbon Risk Real Estate Monitor (CRREM) which helps us chart when a building will effectively become a ‘stranded asset’ based on existing energy use, proposed legislative changes and science-based climate change targets. This helps us understand whether the proposed changes and timescale will remove the risk of future asset stranding. CRREM has European capability allowing us to offer a PMR and APMR service in the UK but also on the continent - helping to ensure a consistent approach to asset management for pan European portfolios.

EPCs become a by-product of asset management not a box-ticking exercise

If the DSM model is updated whenever major refurbishments are completed, then the model is always accurate and could potentially accompany a building through multiple owners. This means EPCs can be generated whenever they are needed without the cost of rebuilding the model each time.

This is also worth doing because the methodology underpinning EPC calculations is updated periodically.

Why? Well, this is where it gets a bit technical. An EPC is an assessment of carbon emissions through predicted energy use. This is calculated through a National Calculation Method (NCM) using carbon emissions factors detailed in a document called the Standard Assessment Procedure, or SAP. These emission factors must be updated to reflect changes such as the decarbonisation of the national grid for example. We are currently overdue the most recent update to these factors called SAP10.1.

What it means is that, depending on the characteristics of a particular building, or unit within a building, the EPC band may change irrespective of any improvement works undertaken. Therefore, even if an EPC for a property is current (i.e. less than ten years old), it is worth doing regular validations to check if the EPC rating would remain the same if it were commissioned today.

Collaboration is key

It is really important that managing agents and property advisors work alongside building services engineers and lawyers to navigate our way through this complex and changeable terrain. That’s why resero were so pleased to have been asked to contribute to this guidance note. Only through collaboration and joined up thinking can we accelerate our progress on sustainability which has been painfully slow in this sector to-date.

Download the full guidance note here.

If you would like to know more about our approach to managing MEES risks please contact acooper@resero.co.uk.